pacman::p_load(tidyverse, patchwork, ggthemes, hrbrthemes, ggrepel, ggiraph, ggstatsplot, PMCMRplus, performance, parameters, see, plotly, factoextra)Take-home Exercise03

Uncover the Patterns of the Resale Prices

1. Overview

1.1 Introduction

In this take-home exercise, the patterns of the resale prices of public housing property in Singapore will be revealed by using static and interactive visualization techniques.

The study mainly focuses on 3-ROOM, 4-ROOM, and 5-ROOM types to discover Singapore’s resale property market in 2022. In the homework, the following questions will be addressed:

What are the general features of the resale property in 2022?

How do different factors influence the price of the resale property?

How can we categorize the existing resale properties in Singapore in 2022?

1.2 Methodology

The study first tests the normality of the main indicators to see if any of the factors are directly related to price. Then exploratory data analysis is adopted to uncover the general features of the resale property market in Singapore. Lastly, correlation analysis is introduced to find how different factors influence the resale prices and how to categorize the large pool of properties to give suggestions on property purchasing.

2. Data Preparation

2.1 Install and Load Packages

Use paccman:: to install required R packages and load them onto RStudio environment.

2.2 Import Datasets

The raw dataset is imported using read_csv( ) and named as “resale”. The following code chunk is used to have an overview of the datasets.

resale <- read_csv("data/resale_price.csv")

head(resale)# A tibble: 6 × 11

month town flat_…¹ block stree…² store…³ floor…⁴ flat_…⁵ lease…⁶ remai…⁷

<chr> <chr> <chr> <chr> <chr> <chr> <dbl> <chr> <dbl> <chr>

1 Jan-17 ANG MO K… 2 ROOM 406 ANG MO… 10 TO … 44 Improv… 1979 61 yea…

2 Jan-17 ANG MO K… 3 ROOM 108 ANG MO… 01 TO … 67 New Ge… 1978 60 yea…

3 Jan-17 ANG MO K… 3 ROOM 602 ANG MO… 01 TO … 67 New Ge… 1980 62 yea…

4 Jan-17 ANG MO K… 3 ROOM 465 ANG MO… 04 TO … 68 New Ge… 1980 62 yea…

5 Jan-17 ANG MO K… 3 ROOM 601 ANG MO… 01 TO … 67 New Ge… 1980 62 yea…

6 Jan-17 ANG MO K… 3 ROOM 150 ANG MO… 01 TO … 68 New Ge… 1981 63 yea…

# … with 1 more variable: resale_price <dbl>, and abbreviated variable names

# ¹flat_type, ²street_name, ³storey_range, ⁴floor_area_sqm, ⁵flat_model,

# ⁶lease_commence_date, ⁷remaining_lease2.3 Data Wrangling

2.3.1 Filter Data

Use filter( ) to select the data of “3 ROOM”, “4 ROOM” and “5 ROOM”. Since we only want the statistics of 2022, the data contains the string of “22” is filtered under the month column.

resale_filter <-

resale %>%

filter(flat_type == c("5 ROOM", "3 ROOM", "4 ROOM")) %>%

filter(str_detect(month,"22")) 2.3.2 Rearrange Data

Separate( ) is adopted to divide year and month of remaining lease and transform( ) is to convert the data of resale_price into “K”. To divide the resale property into low level, middle level and high level, the column of story_range is created after transferring the related data into number. Through these procedures, the tidy version of data is made and names as re.

resale_arrange <-

resale_filter %>%

separate(remaining_lease, into = c("remaining_lease"), sep = "years") %>%

transform(resale_price = resale_price/1000) %>%

separate(storey_range, into = c(NA, "storey"), sep = "TO ")resale_arrange$storey=as.numeric(resale_arrange$storey) re <- resale_arrange %>%

mutate(storey_bins =

cut(storey,

breaks = c(0,9,21,22,51))) %>%

transform(unit_price = resale_price/floor_area_sqm)3. Visualizations and Insights

3.1 Check Normality

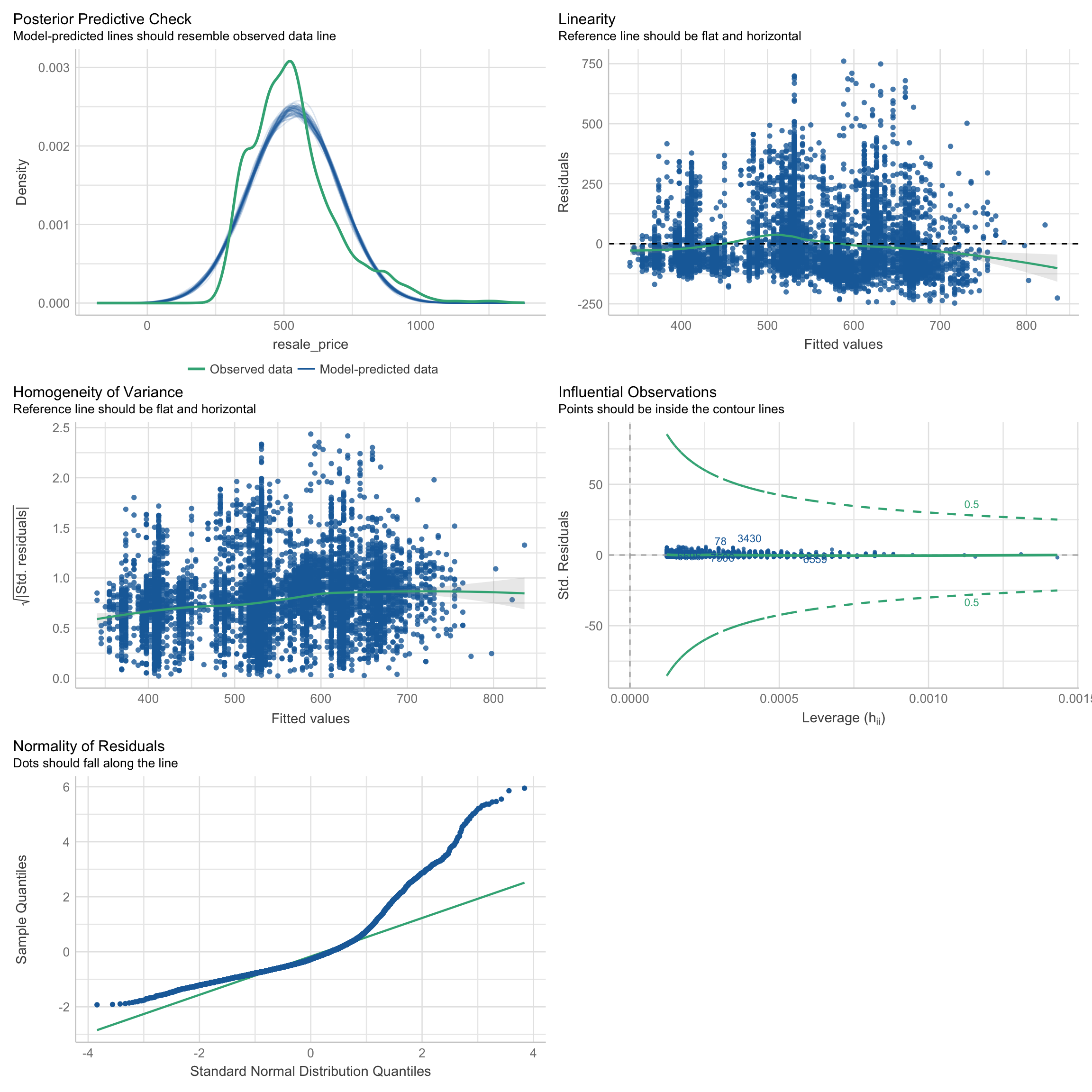

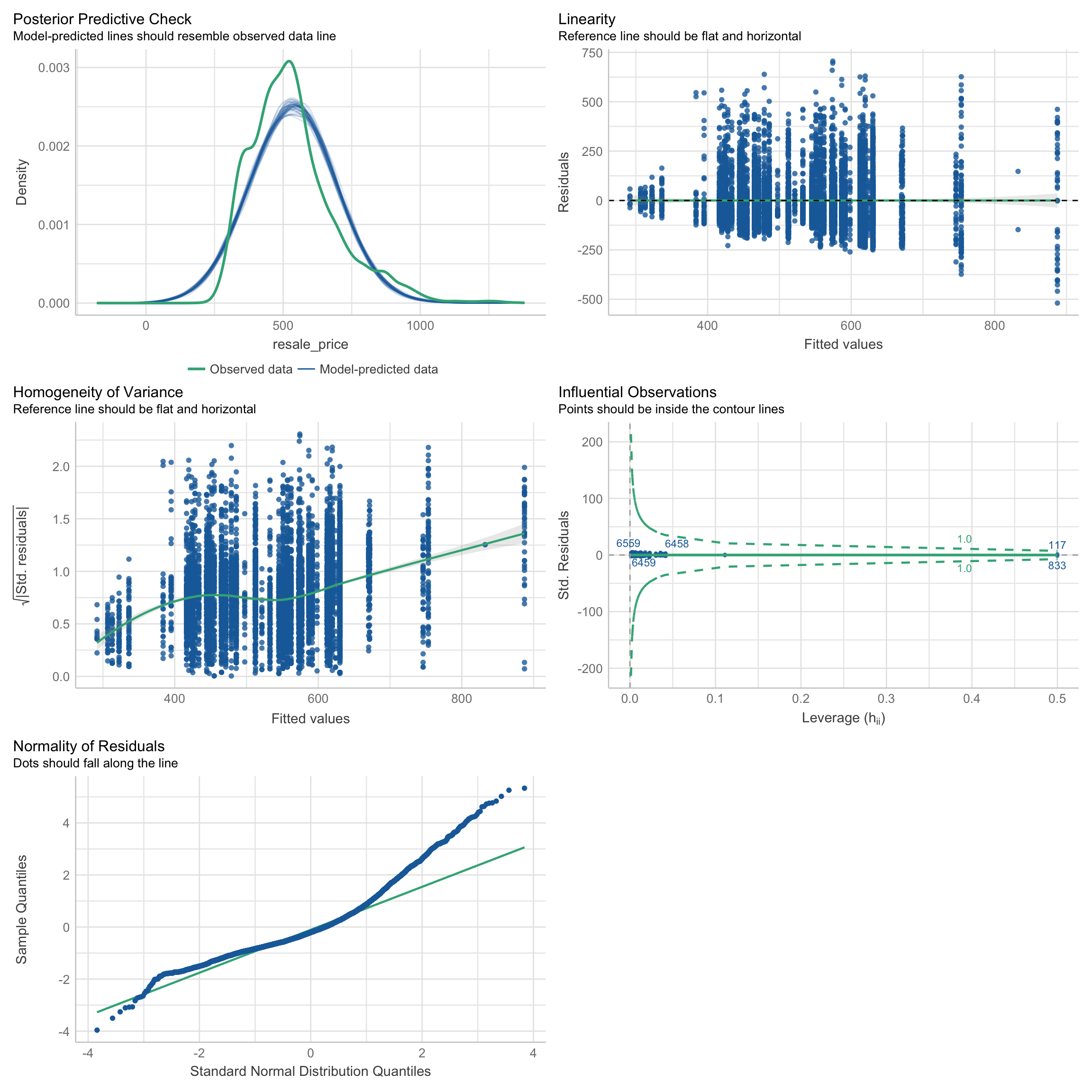

To better understand the data sets, the check_model( ) is adopted to have a general overview of the data. The study assumes that the price of the resale property is related to floor area and remaining release. Hence the data is tested to see if it can directly conduct variance analysis and linear regression modeling.

From the following normality test, the price of the resale property is not satisfied with normal distribution neither with the floor area nor the remaining lease. Therefore, linear regression modeling cannot be directly applied to the analysis of the resale property price.

model_floorarea <- lm(resale_price ~ floor_area_sqm, data = re)check_model(model_floorarea)

model_lease <- lm(resale_price ~ remaining_lease, data = re)check_model(model_lease)

3.2 Visualize Features

3.2.1 Price and Storey of Different Flat Types

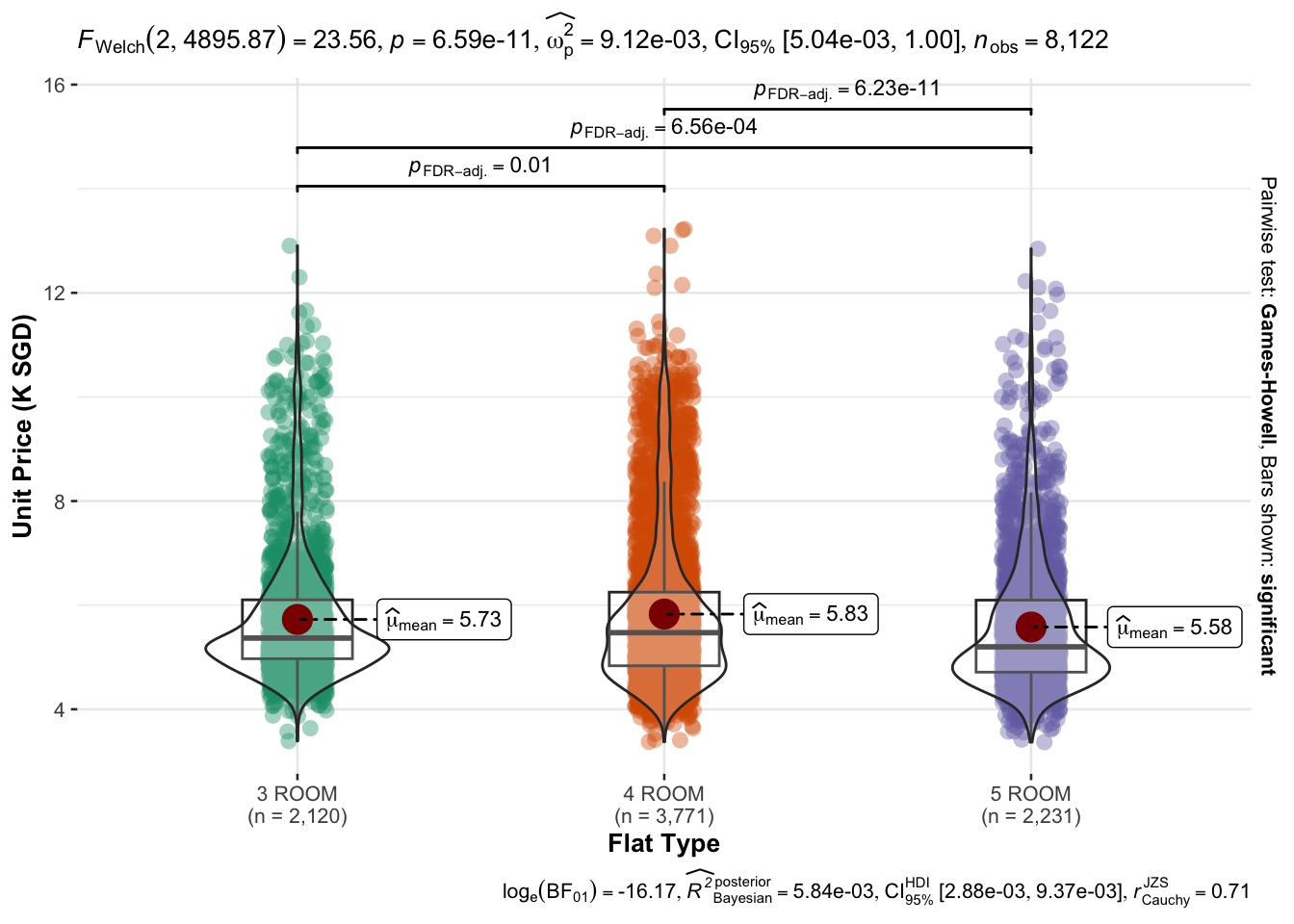

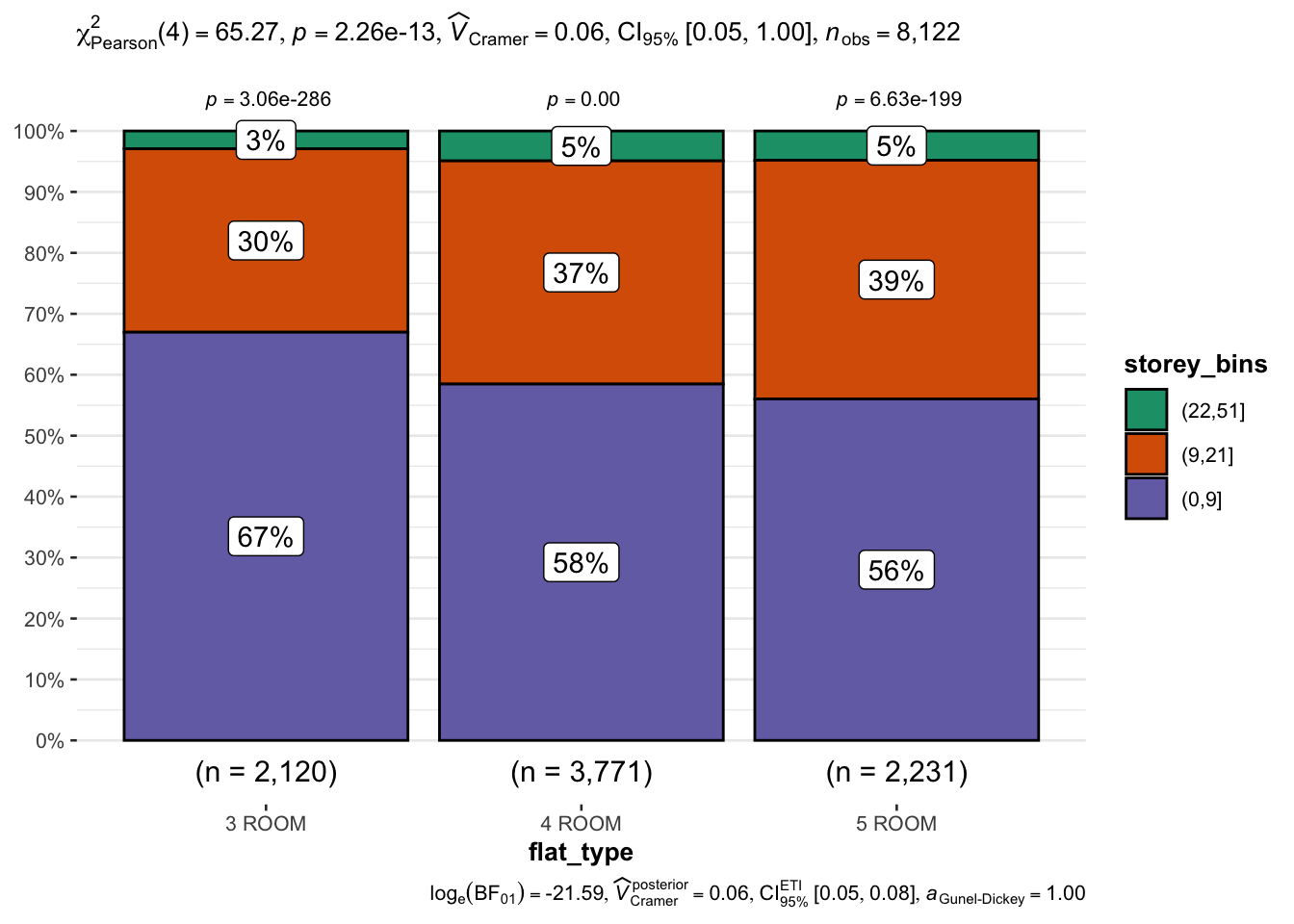

The following static graphs show the price and story range of different flat types, namely 3 ROOM, 4 ROOM, and 5 ROOM. From the plot created by ggbetweenstats( ) and ggbarstats( ), we can tell the mean price and price range and see what the story distribution of each house type is.

The number of 4 ROOM is the highest. The mean price is similar for every flat type. Most of the three-bedroom and five-bedroom unit prices are clustered in the middle and lower reaches and the largest mean price occurs in the 4 room types. As for the story distribution, most resale rooms in the market are located on low floors, which has the largest percentage in 3 ROOM types. This indicates that 3 and 5 room types can be more economic for buyers, and higher stories might have higher prices because of limited second-hand property resources and Singapore’s climate.

ggbetweenstats(

data = re,

x = flat_type,

y = unit_price,

xlab = "Flat Type",

ylab = "Unit Price (K SGD)",

type = "p",

mean.ci = TRUE,

pairwise.comparisons = TRUE,

pairwise.display = "s",

p.adjust.method = "fdr",

messages = FALSE

)

ggbarstats(re,

x = storey_bins,

y = flat_type)

3.2.2 Price by Lease Commence Date and Towns

The dot plot created by plot_ly( ) shows the relationship between the lease commence date and unit price. From the interactive tooltip label on hovering, we can tell the town and flat types the property belong to and have some insights into their relationship.

From the plot, we can see the new flat often sells at higher prices, but there are still many exceptions. For example, some old 3 rooms can have high unit prices because of their location. To specify the influence of locations, the line chart of the price created by giraffe( ) in different towns is shown. Additionally, many rooms at a higher level are much more expensive than their counterparts, which indicates the story can have a tremendous impact on the unit price of resale houses.

plot_ly(data = re,

x = ~lease_commence_date,

y = ~unit_price,

color = ~storey_bins,

text = ~paste("Town:", town,

"<br>Type:", flat_type)) %>%

layout(title = "Relationship of Lease Commence Date with Unit Price", xaxis = list(title = "Lease Commence Date (year)"), yaxis = list(title = "Unit Price (K SGD)" ), legend = list(title=list(text="<b> Storey Bins </b>")))avg_price <- aggregate(re$unit_price, by = list(re$town), mean)avg_price$x=round(avg_price$x,2)

head(avg_price) Group.1 x

1 ANG MO KIO 5.92

2 BEDOK 5.44

3 BISHAN 6.67

4 BUKIT BATOK 5.49

5 BUKIT MERAH 7.21

6 BUKIT PANJANG 5.18p_avg_price <- ggplot(data = avg_price, mapping = aes(x = reorder(Group.1, -x), y = x, group = 1)) + geom_line(colour = 'steelblue', size = 2) + geom_point() + xlab('') + ylab("Unit Price (K SGD)") + theme(axis.text.x = element_text(angle = 45, hjust = 1, vjust = 1)) + labs(title = "Unit Price of Different Towns") + theme(plot.title = element_text(size=12,hjust=0.5)) + geom_point_interactive(aes(tooltip = x, data_id = x)) + scale_y_continuous(limits = c(3, 9))

girafe(ggobj = p_avg_price,

width_svg = 6,

height_svg = 6*0.618)3.3 Visualize Correlation

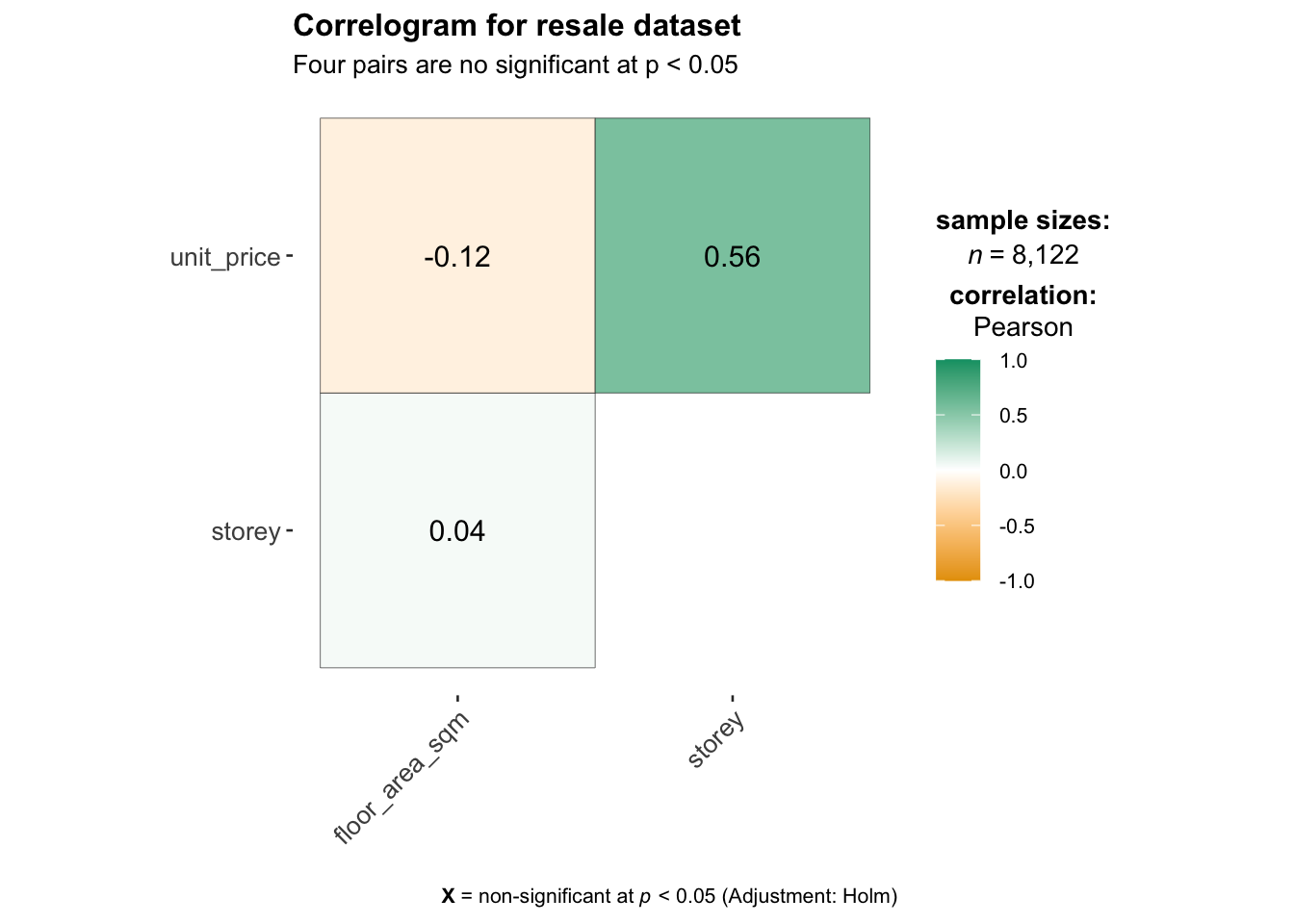

To substantiate the findings in the visualization of the features, a correlogram is used to show key elements related to unit prices. The feature of the lease commence date is omitted in the graph because its P is larger than 0.05.

ggstatsplot::ggcorrmat(data = re, cor.vars = c(6:7,10,13),

ggcorrplot.args = list(outline.color = "black",

hc.order = TRUE,

tl.cex = 10),

title = "Correlogram for resale dataset",

subtitle = "Four pairs are no significant at p < 0.05"

)

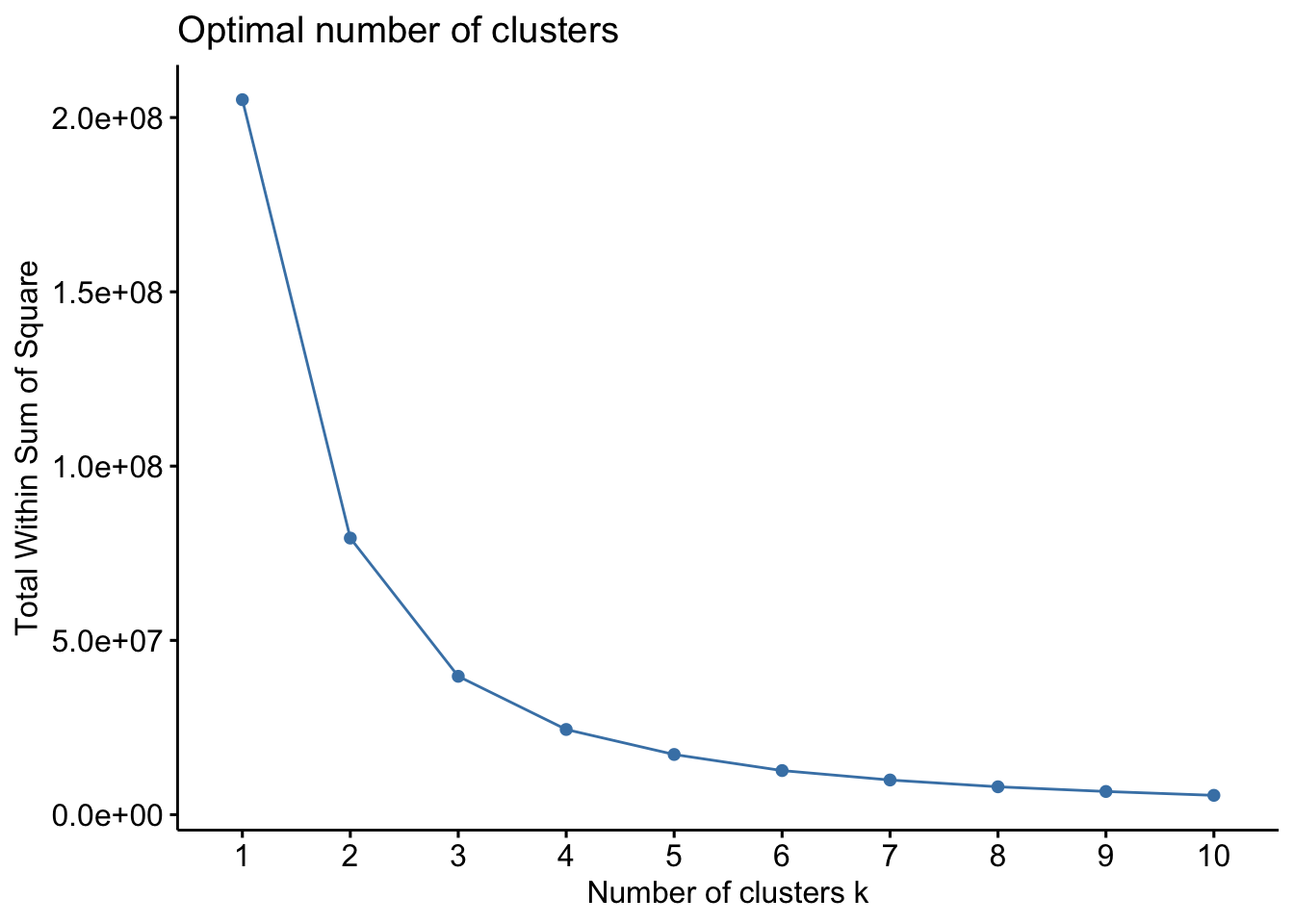

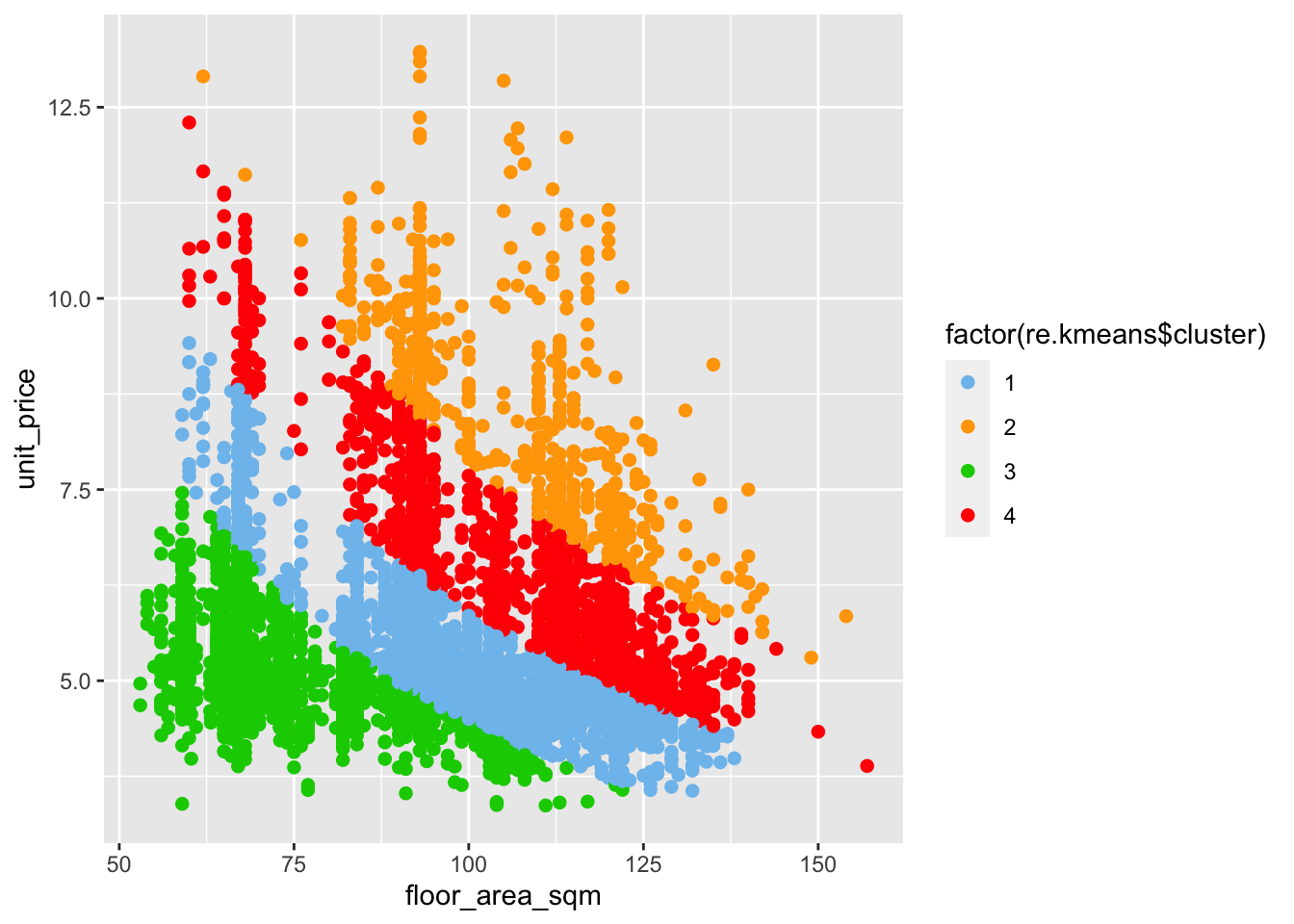

After the correlogram, clustering is adopted to categorize different house types. By using fviz_nbclust( ), it can be seen the best number for clustering is 4. K-means (introduce “floor_area_sqm”, “resale_price”, “unit_price”) is used to do modeling and present the statistics in terms of “town”and “storey_bins”in a table. The summarized features of four types of properties are listed in the table, and a dot plot is created to visualize the clustering of different categorizations by using ggplot2( ).

dim(re)[1] 8122 13fviz_nbclust(re[c("floor_area_sqm","resale_price","unit_price")], kmeans, method = "wss")

re.kmeans <- kmeans(re[c("floor_area_sqm","resale_price","unit_price")], centers = 4, nstart = 25)

table(re.kmeans$cluster)

1 2 3 4

3402 647 2437 1636 table(re$town, re.kmeans$cluster)

1 2 3 4

ANG MO KIO 55 48 182 41

BEDOK 100 13 227 86

BISHAN 25 41 18 57

BUKIT BATOK 82 18 114 54

BUKIT MERAH 40 105 85 78

BUKIT PANJANG 153 4 71 54

BUKIT TIMAH 6 6 4 4

CENTRAL AREA 19 27 15 9

CHOA CHU KANG 271 0 80 77

CLEMENTI 35 35 82 43

GEYLANG 49 23 110 30

HOUGANG 162 12 125 93

JURONG EAST 49 0 71 26

JURONG WEST 247 0 181 51

KALLANG/WHAMPOA 57 88 83 73

MARINE PARADE 19 14 24 6

PASIR RIS 118 1 3 73

PUNGGOL 395 14 63 173

QUEENSTOWN 14 101 77 54

SEMBAWANG 150 0 35 42

SENGKANG 457 13 74 162

SERANGOON 45 8 37 32

TAMPINES 232 18 110 133

TOA PAYOH 30 58 120 60

WOODLANDS 339 0 163 49

YISHUN 253 0 283 76table(re$storey_bins, re.kmeans$cluster)

1 2 3 4

(0,9] 2080 163 1820 812

(9,21] 1272 286 609 726

(21,22] 0 0 0 0

(22,51] 50 198 8 98aggregate(re[c("floor_area_sqm","resale_price","unit_price")], list(re.kmeans$cluster),mean) Group.1 floor_area_sqm resale_price unit_price

1 1 99.79865 517.4858 5.278806

2 2 106.14529 903.6884 8.654521

3 3 74.18182 376.2775 5.140513

4 4 107.06968 667.8437 6.407326| No. | Size | Price | Storage | Location Distribution |

|---|---|---|---|---|

| 1 | Middle | Moderate | Mainly low level and middle level, few high level | Punggol, Woodlands, Choa Chu Kang |

| 2 | Small | Cost-effective | Mainly low level | Yishun, Bedok, Woodlands |

| 3 | Large | Pricey | Mainly high level | Central Area, Bukit Merah, Kallang, Queenstown |

| 4 | Large | Moderate | Mainly low level and middle level, few high level | Bedok, Hougang, Punggol, Sengkang, Tampines |

p_cluster <- ggplot(data = re[c("floor_area_sqm","resale_price","unit_price")], mapping = aes(x = floor_area_sqm, y = unit_price, color = factor(re.kmeans$cluster)))

p_cluster <- p_cluster + geom_point(pch = 20, size = 3)

p_cluster + scale_colour_manual(values = c("skyblue2", "orange", "green3","red"))

4. Learning Point

In this take-home exercise, interactive and statistic visualization R packages, such as plotly, ggiraph, ggstatsplot are applied to uncover the patterns of resale prices. My key takeaways are:

Rstudio is a powerful tool when doing interactive visualizations, which provides more options for audience to select details for customized viewing. In this assignment, I find it difficult to integrate various information together as there are many elements that should be taken into consideration. Additionally, if a project contains data modeling, a special design must be adopted to make the graph both lively and understandable.

When introducing statistical methods into the visualization analysis, the graph can provide more details. Having a basic understanding of statics is essential for us to do data modeling, and I still need to improve my skills in doing it since I often lack creative ideas in arranging and interpreting data.